Market Overview: The Current Landscape

The dog insurance market is experiencing unprecedented growth, with the U.S. pet insurance market growing at 22.1% annually and valued at $4.99 billion in 2024, expected to reach $6.06 billion in 2025. This surge is driven by escalating veterinary costs, increased awareness of breed-specific health risks, and pet owners’ growing willingness to invest in their dogs’ healthcare.

Key Market Trends:

- Rising Vet Costs: Emergency surgeries can cost $3,000-$10,000+, making insurance increasingly valuable

- Telemedicine Integration: Most providers now offer 24/7 virtual vet consultations

- Breed-Specific Pricing: Rottweilers average $88.76/month while Chihuahuas average only $38.45/month

- Wellness Add-ons: Preventive care coverage becoming standard

- Direct Vet Pay: More companies offering payment directly to veterinarians

Average Costs:

Dog insurance ranges from $26-$277 monthly, with the national average at approximately $62 per month for comprehensive accident and illness coverage.

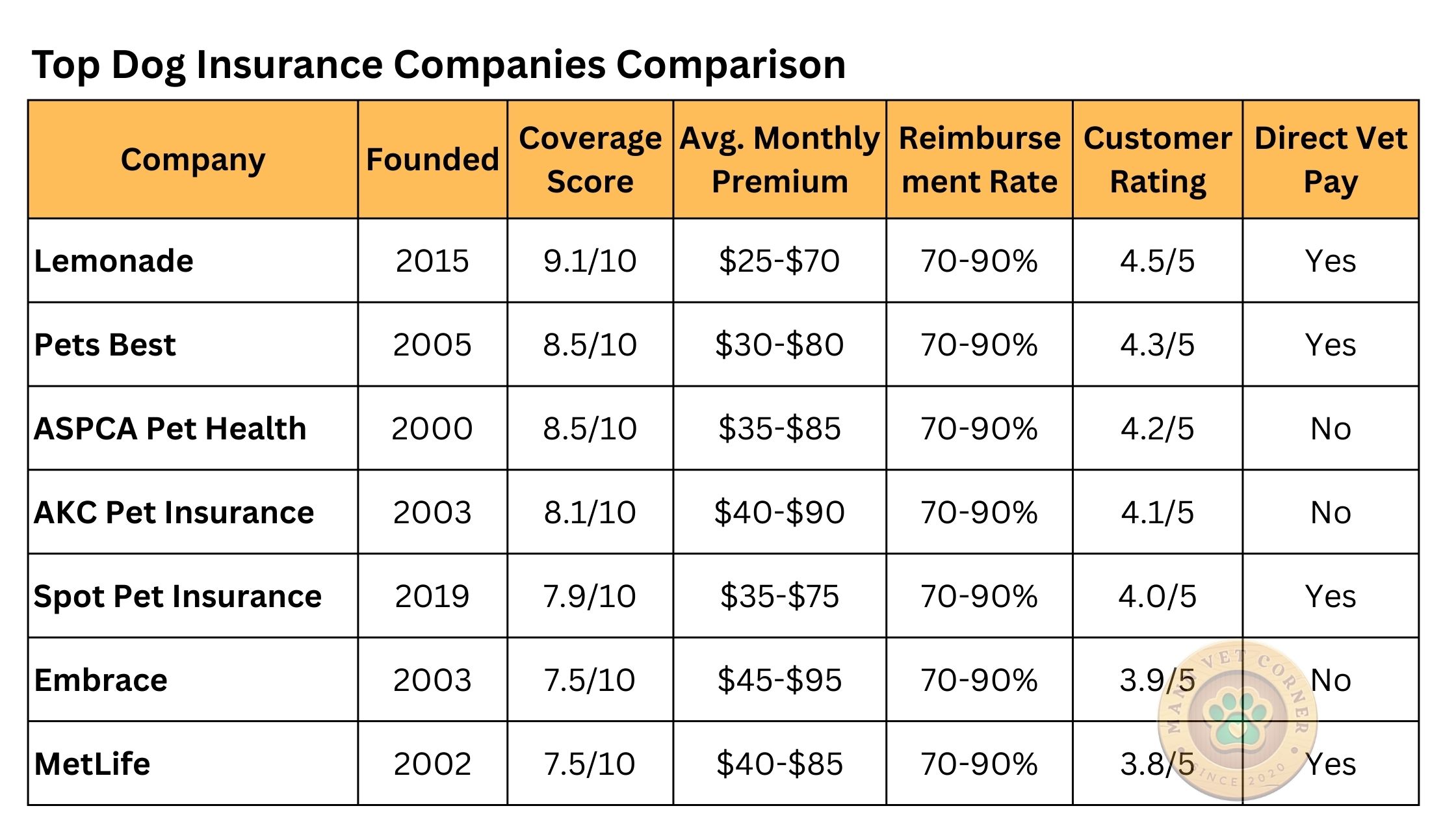

Detailed Company Analysis:

1. Lemonade Pet Insurance

Founded: 2015 Key Coverage: Accident & illness, optional wellness, hereditary conditions

- Pros:

- AI-powered claims processing (under 3 minutes for simple claims)

- No breed exclusions

- 24/7 vet chat included

- Multi-pet discounts up to 10%

- Cons:

- 2-day waiting period for accidents, 14 days for illnesses

- Limited to dogs under 14 years for new policies

- Not available in all states

- Sample Cost: Labrador (age 3): $45/month for $10,000 annual limit, 80% reimbursement, $250 deductible

- Unique Features: Ranked top for customer service satisfaction and claims handling, giveback program donating unclaimed premiums to animal charities

- Website: https://www.lemonade.com/pet

- Phone: (844) 733-8666

- Email: help@lemonade.com

- Claims Email: claims@lemonade.com

- Primary Contact Method: Mobile app or online portal (preferred)

2. Pets Best Insurance

Founded: 2005 Key Coverage: Accident-only, accident & illness, wellness plans

- Pros:

- Consistently competitive rates and vet direct pay option

- No upper age limits for enrollment

- Covers exam fees

- 24/7 pet helpline

- Cons:

- 14-day waiting period for illnesses

- 6-month waiting period for cruciate ligament issues

- Some hereditary conditions excluded

- Sample Cost: Labrador (age 3): $52/month for $10,000 annual limit, 80% reimbursement, $250 deductible

- Unique Features: BestBenefit plan with no annual limits, routine care coverage available

- Website: https://www.petsbest.com

- Phone: Customer service numbers vary by inquiry type (check website)

3. ASPCA Pet Health Insurance

Founded: 2000 Key Coverage: Complete coverage for accidents, illnesses, hereditary conditions

- Pros:

- Customizable accident-and-illness plans with wellness coverage tiers

- Covers behavioral treatments

- No breed restrictions

- Supports ASPCA’s animal welfare mission

- Cons:

- Higher premiums for comprehensive coverage

- 14-day waiting period for illnesses

- Pre-existing condition exclusions

- Sample Cost: Labrador (age 3): $58/month for $10,000 annual limit, 80% reimbursement, $250 deductible

- Unique Features: Preventive care rewards program, emergency boarding coverage

- Website: https://www.aspcapetinsurance.com

- Phone: Contact information available on website

4. AKC Pet Insurance

Founded: 2003 (partnership with PetPartners) Key Coverage: Accident & illness, optional wellness

- Pros:

- American Kennel Club endorsement

- Covers hereditary and congenital conditions

- Flexible deductible options

- Prescription food coverage for medical conditions

- Cons:

- 14-day waiting period for illnesses

- Age restrictions for new enrollments

- Limited availability in some states

- Sample Cost: Labrador (age 3): $55/month for $10,000 annual limit, 80% reimbursement, $250 deductible

- Unique Features: Breed-specific expertise, AKC member discounts

- Website: https://www.akcpetinsurance.com

- Phone: (866) 725-2747

- Email: Contact form available on website

5. Spot Pet Insurance

Founded: 2019 Key Coverage: Accident & illness, preventive care

- Pros:

- Listed among top picks by multiple review sites

- Unlimited annual benefits option

- No upper age limit for coverage continuation

- Direct vet payment available

- Cons:

- Relatively new company with limited track record

- 14-day waiting period for illnesses

- Hip dysplasia waiting period up to 12 months

- Sample Cost: Labrador (age 3): $48/month for $10,000 annual limit, 80% reimbursement, $250 deductible

- Unique Features: Gold plan with unlimited coverage, preventive care plans

- Website: https://spotpetins.com

- Phone: Available on website

6. Embrace Pet Insurance

Founded: 2003 Key Coverage: Accident & illness, wellness rewards

- Pros:

- Diminishing deductible (reduces by $50 each year claim-free)

- Covers dental treatment for accidents

- Wellness rewards program

- Personal pet insurance advisor

- Cons:

- Higher premiums than some competitors

- 14-day waiting period for illnesses

- 6-month orthopedic waiting period

- Sample Cost: Labrador (age 3): $62/month for $10,000 annual limit, 80% reimbursement, $250 deductible

- Unique Features: Healthy pet deductible reduction, wellness rewards up to $350 annually

- Website: https://www.embracepetinsurance.com

- Phone: (800) 511-9172

- Contact Page: https://www.embracepetinsurance.com/contact-us

7. MetLife Pet Insurance

Founded: 2002 Key Coverage: Comprehensive accident & illness plans

- Pros:

- Among top-rated companies by NerdWallet

- Direct vet payment option

- No breed exclusions

- Covers alternative therapies

- Cons:

- 14-day waiting period for illnesses

- Pre-existing condition exclusions

- Limited wellness coverage options

- Sample Cost: Labrador (age 3): $56/month for $10,000 annual limit, 80% reimbursement, $250 deductible

- Unique Features: MetLife brand recognition, alternative therapy coverage

- Website: https://www.metlifepetinsurance.com

- Phone:

- General Customer Service: (866) 937-7387

- Alternative Number: (855) 270-7387

- Customer Support: https://www.metlifepetinsurance.com/customer-support/

Key Factors to Consider When Choosing

1. By Dog Breed:

- Brachycephalic breeds (Bulldogs, Pugs): Expect 30-50% higher premiums due to respiratory issues

- Large breeds (Great Danes, Mastiffs): Higher orthopedic coverage needs, longer waiting periods

- Mixed breeds: Often lower premiums than purebreds with fewer genetic predispositions

2. By Location:

- High-cost areas (California, New York): Premiums 20-40% above national average

- State regulations: Some states mandate certain coverage minimums

- Vet availability: Rural areas may have limited direct-pay options

3. By Lifestyle:

- Active/Adventure dogs: Look for injury coverage, alternative therapies

- Indoor dogs: May qualify for lower-risk pricing

- Multi-pet households: Seek companies offering family discounts

Policy Fine Print Essentials:

- Pre-existing conditions: Most exclude, but some cover “curable” conditions after waiting periods

- Hereditary vs. congenital: Understand the difference in coverage

- Annual vs. lifetime limits: Unlimited options worth the extra cost

- Deductible structure: Per-incident vs. annual can significantly impact costs

Real User Insights

Common Praise Points:

- Lemonade: “Claims processed in minutes through the app” – consistently mentioned in reviews

- Pets Best: “Direct vet payment saved me from paying $4,000 upfront for surgery”

- ASPCA: “Covered my rescue dog’s hip dysplasia treatment fully”

Frequent Complaints:

- Embrace: Users report claims denied for hip dysplasia citing hereditary exclusions

- Multiple providers: Waiting periods longer than advertised for orthopedic conditions

- Industry-wide: Difficulty understanding what constitutes a “pre-existing condition”

Top Recommendations by Need

🏆 Best Overall Value: Lemonade Pet Insurance

- Competitive pricing with excellent digital experience

- Fast claims processing and comprehensive coverage

- No breed exclusions with solid customer satisfaction

💰 Best for Budget-Conscious: Pets Best

- Consistently low premiums across age groups

- Accident-only plans starting at $10-15/month

- Direct vet payment reduces out-of-pocket burden

🐕🦺 Best for Senior Dogs: ASPCA Pet Health Insurance

- No upper age enrollment limits

- Comprehensive coverage for age-related conditions

- Customizable plans to fit changing needs

🧬 Best for Purebred Dogs: AKC Pet Insurance

- Breed-specific expertise and understanding

- Strong hereditary condition coverage

- AKC endorsement adds credibility for purebred owners

Getting Started: Your Action Plan

- Get Multiple Quotes: Compare at least 3 providers using identical coverage parameters

- Free Trials: Look for 30-day money-back guarantees or trial periods

- Read Reviews: Check recent customer experiences on Trustpilot, Google Reviews

- Vet Compatibility: Confirm your veterinarian accepts direct payment if important to you

- Start Early: Enroll while your dog is young and healthy to avoid pre-existing exclusions

Sample Quote Parameters for Comparison:

- Dog breed and age

- Your ZIP code

- $5,000-$10,000 annual limit

- 80% reimbursement rate

- $250-$500 deductible

- Include wellness coverage if desired

Remember: 76% of dog owners overestimate pet insurance costs by three times the actual average price. The peace of mind and financial protection often outweigh the monthly investment, especially when facing unexpected veterinary emergencies that can easily exceed $5,000.

Keywords: Dog insurance, pet insurance, accident coverage, illness coverage, hereditary conditions, wellness plans, pre-existing conditions, Premiums, deductibles, reimbursement rates, annual limits, waiting periods, claims processing, direct vet payment, Breed exclusions, brachycephalic breeds, purebred dogs, senior dogs, multi-pet discounts, hereditary conditions.